|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

Market Makers Are Overpricing Iron Mountain’s (IRM) Options Tail—This is How You Can Take Advantage

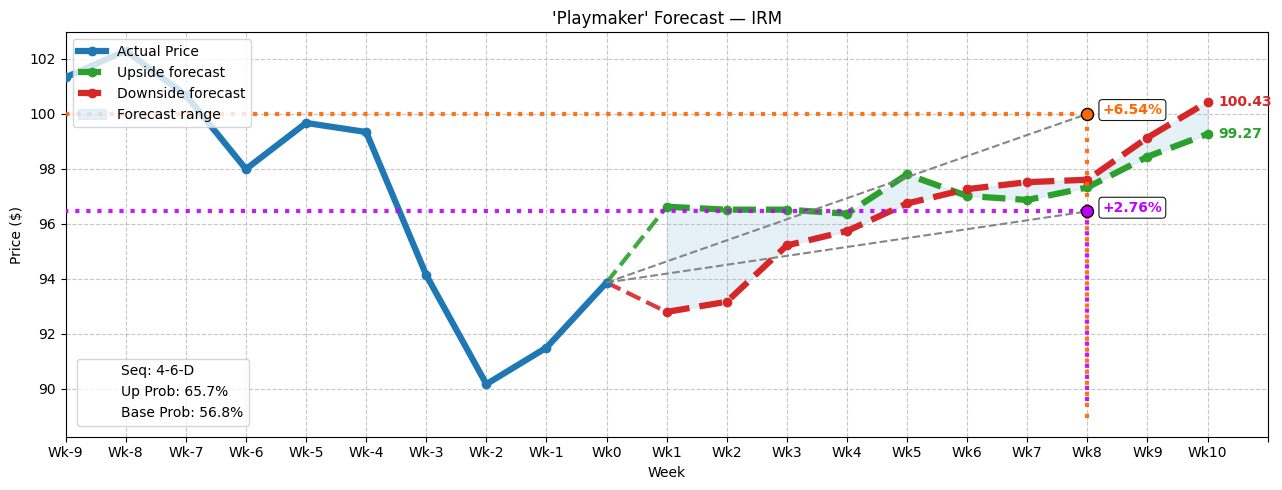

Although it’s a boring enterprise by default, information management specialist Iron Mountain (IRM) may be one of the most compelling names for contrarian speculators. You see, IRM stock appears to be a dud, with the Barchart Technical Opinion indicator rating it a 72% Strong Sell. That’s not exactly a ringing endorsement. Further, while IRM stock enjoys a Moderate Buy assessment among Wall Street analysts, among 10 experts, one of the ratings is a Hold while the other is a Strong Sell. Sure, seven other analysts view IRM as a Strong Buy and a lone bull rates it as a Moderate Buy. However, the more skeptical opinions stand out, simply because the security is down almost 13% year-to-date. Essentially, the company is going through a rough patch, forcing market makers to bake-in insurance against extreme outcomes. In other words, these liquidity providers will effectively charge a premium for downside protection. Mathematically, the implied distribution will have a fatter downside tail than would normally be expected. Put in simple terms, IRM stock options could be mispriced, particularly because the pricing is accounting for a black swan event that is arguably not likely to happen. Further, what makes Iron Mountain compelling now is the unusual options activity. IRM stock ranked among the top 500 securities witnessing aberrant transactions in the derivatives arena relative to prior norms. Interestingly, the activity seems to suggest pessimism. Looking at Barchart’s options flow screener — which focuses exclusively on big block transactions likely placed by institutional investors — net trade sentiment was $8,400 below parity, thus favoring the bears. That’s a small dollar amount, to be sure. What’s notable, though, is that gross bullish volume was zero. Thus, the implication was that professional traders saw downside risk in IRM stock. With the equity down 2.21% in the open market, skepticism is high — which is counterintuitively why Iron Mountain is so intriguing. Potentially Mispriced IRM Stock Options Could Be a Massive StealBuy-and-hold investors have the most straightforward job: find a security that they like and buy it in the open market. However, this process can be a bit vanilla, which is where options trading comes in. By using their leverage and the unique geometry of multi-leg strategies, traders can turn small movements in the open market into massive gains in the options market. Of course, game planning is everything in short-term speculative activities. Typically, most traders depend on volatility-dependent analytics. By taking calculations derived from the Black-Scholes-Merton formula, they add (or diminish) an accelerant to the security’s baseline volatility metric, depending on the presence of exogenous factors (such as upcoming earnings reports). By modulating expected volatility, it’s possible to extract an upside and downside price range (which is roughly one standard deviation above and below the current price). But here’s where the mispricing comes into play: if the security is less likely to tumble, for example, it shouldn’t be necessary to hedge a standard deviation (or more) to the downside. Still, the issue is determining whether the downside insurance policy is likely to be needed or not. That’s where pathway dependency comes into the frame. Rather than modulating volatility and projecting an outward price range, pathway dependency seeks to identify the current behavioral state and build a forecast model based on conditional past analogs. This approach respects the actual pricing geometry of the target stock. However, the disadvantage is that pathway dependency — by logical deduction — requires prior pathways. If there is a lack of data to work with, this methodology (outside of using advanced Bayesian inference) is functionally useless. Fortunately, this doesn’t apply to IRM stock. More importantly, Iron Mountain could be signaling a sentiment reversal. In the past 10 weeks, IRM stock has printed a “4-6-D” sequence: four up weeks, six down weeks, with an overall negative trajectory. Since January 2019, this sequence has materialized 35 times. In 65.71% of cases, the following week’s price action results in upside, with a median return of 2.94%.  Now, here’s where things get interesting. If IRM stock follows the positive pathway from week one onwards, past analogs of the 4-6-D suggest that the security could reach $99.27 over the next 10 weeks. If the negative pathway wins out, the 10-week forecast is pointing toward a price of $100.43. In other words, the 4-6-D sequence tends to produce a risk-reward inversion. Therefore, the downside risk tail could be overpriced, leading to a tantalizing proposition for IRM stock. A Bold But Surprisingly Rational TradeIntrepid speculators may consider the 95/100 bull call spread expiring Oct. 17. This transaction involves buying the $95 call and simultaneously selling the $100 call, for a net debit of $145 (the most that can be in the trade). Should IRM stock rise through the short strike price ($100) at expiration, the maximum profit is $355, a payout of nearly 245%. To be fair, this is an extremely aggressive position because the short strike price is currently 6.54% above Friday’s close of $93.86. That’s above the projected median boundaries anticipated by the 4-6-D sequence. Put another way, you’ll need to see an above-average performance for this trade to be fully profitable. That said, the breakeven price for the aforementioned bull spread is $96.45. That’s 2.76% above Friday’s close, which is very much a doable target based on past analogs. If you’re looking for a high-leverage wager that relatively few are paying attention to, Iron Mountain is it. On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|