|

|

|

Name

Cash Bids

News

Ag Commentary

Weather

Resources

|

As Hertz Moves to Sell Cars on Amazon, Is HTZ Stock a Buy, Sell, or Hold?

Hertz (HTZ) has attracted attention in the mobility sector by making a unique deal to sell its used vehicles directly on Amazon.com (AMZN). Following the Aug. 20 announcement, HTZ shares rose more than 5%, reflecting investor interest in new sales channels as the industry moves toward digital retail. The car rental market is strong itself, with global revenue expected to reach $106.37 billion in 2025. Analysts predict that the market will grow about 5% annually through 2030, supported by increasing tourism and corporate travel. In this setting, Hertz’s move disrupted both traditional car dealerships and online-only sellers, particularly Carvana (CVNA), whose shares dropped 4.3 percent the same day amid concerns about tougher competition. With Amazon’s wide customer reach and easy checkout process, Hertz could increase the turnover and profit margins on its used cars, potentially shifting how the used car market works. Still, there are questions about how well Hertz can manage inventory, integrate systems, and maintain margins. As investors consider these factors, one question stands out: Is HTZ stock a strong buy, a cautious hold, or a sell given these strategic changes and industry expectations? Let's find out. Hertz’s Financial Health and MomentumHertz, best known for its car rental business, has been expanding its focus to include used car sales, responding to the growing demand for pre-owned vehicles. Over the past 52 weeks, HTZ stock has risen significantly by 57.43%, with a year-to-date (YTD) gain of 47.54%, reflecting strong investor interest after the company announced new sales channels.

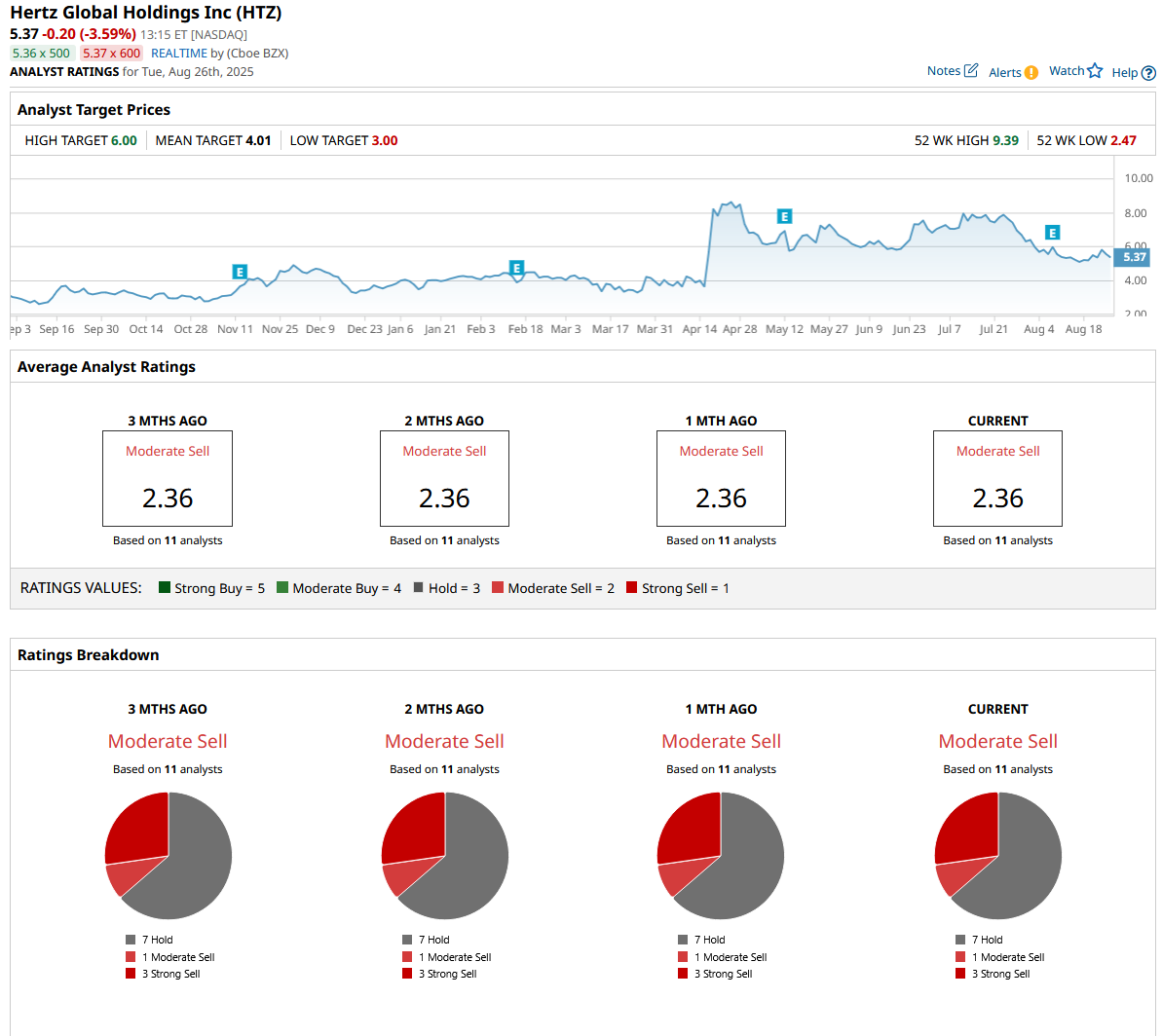

Even with this positive momentum, Hertz’s valuation remains complicated. The company has a market capitalization of roughly $1.7 billion, with earnings per share at negative $3.32 and a recent quarterly loss of $0.34 per share reported in early August. From a financial standpoint, Hertz has shown clear progress in managing its operations more efficiently. Net income and adjusted corporate EBITDA improved by about $500 million compared to the same period last year, marking the first quarter of positive adjusted EBITDA in nearly two years. Vehicle utilization increased to 83%, up 300 basis points from the previous year, showing a more streamlined fleet with close to 80 percent of vehicles less than a year old. Depreciation costs per unit per month stood at $251, well below the target of $300, which points to effective fleet management. The company also posted its highest second-quarter retail vehicle sales volume in five years, helped by strong demand for used cars and direct sales to consumers. At the same time, Hertz maintains a healthy liquidity position with more than $1.45 billion in cash at the end of the quarter, providing a solid cushion as it pushes forward with its growth plans. The Strategic Drivers Behind Hertz’s Digital ExpansionHertz’s push into digital sales is centered on its recent partnership with Amazon, which changes how people can buy cars online. By listing thousands of pre-owned vehicles on Amazon Autos, Hertz gains access to Amazon’s vast customer base and smooth shopping process. This partnership opens up new sales opportunities and fits into Hertz’s broader plan to work with technology partners to make buying a car easier and more convenient. The effort is rolling out in cities like Dallas, Houston, Los Angeles, and Seattle, and the company plans to expand it to all 45 of its Car Sales locations, aiming to take advantage of the growing trend of buying cars online. Another key factor is Hertz’s expansion of its Rent2Buy program to over 100 cities across the country. This program lets customers take a used car for an extended test drive by renting it for up to three days with a small daily fee. If they decide to buy, the rental fee is waived. This approach helps address a common hesitation among used car buyers – the worry of committing without enough time to try the car. With about 80 percent of renters ending up purchasing the vehicle, Rent2Buy builds trust and increases sales, directly supporting Hertz’s growing retail business. What Analysts Say About HTZ’s Road AheadLooking ahead, the earnings estimates for Hertz show a surprisingly positive trend despite recent losses. For the quarter ending September 2025, the average forecast predicts a small profit of 20 cents per share, a big improvement from the loss of 68 cents per share in the same period last year. This cautious optimism stands in sharp contrast to the strong confidence shown by activist investor Bill Ackman. His firm, Pershing Square Holdings, bought almost 20 percent of Hertz earlier in 2025, signaling his belief in the company’s turnaround and new strategy. Ackman has openly said he believes HTZ stock could reach $30 by the end of the decade, which would be over a 400 percent increase from current prices around $5.90. He bases this view on improvements in Hertz’s operations, careful management of its fleet, and its move into selling used cars online through Amazon, a step he sees as a challenge to online players like Carvana. Still, most analysts remain skeptical. All 11 surveyed give the stock a consensus rating of “moderate sell,” with an average price target of just $4.01, well below where the stock is trading now. This difference highlights a clear split between investor enthusiasm and analyst caution as Hertz moves forward. ConclusionHertz’s move to sell cars on Amazon is a bold step that clearly energizes its growth story and sets it apart in a competitive market. While operational improvements and digital expansion offer real potential, the mix of bullish investor backing and cautious analyst sentiment reflects the uncertainty ahead. Given the strong momentum and innovative strategy, HTZ shares look more like a cautious hold with upside potential, rather than an outright buy or sell. Investors should watch closely how Hertz executes this vision, but for now, the stock seems positioned to capitalize on its new channels, just with some risks to keep in mind.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|